Popular Posts

Automotive

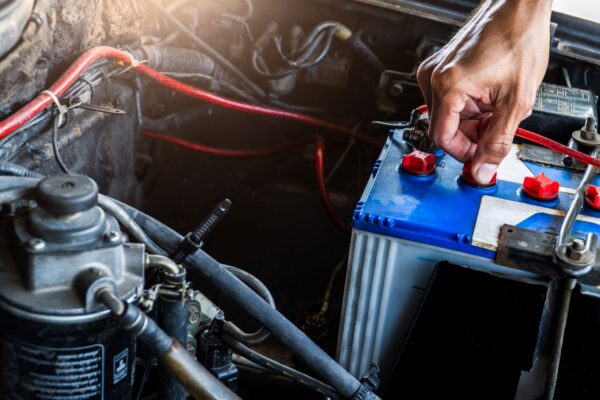

4 วิธีการดูแลแบตเตอรี่รถยนต์

ปัจจุบันทุกๆ ท่านต่างก็คงจะมีรถยนต์เป็นพาหนะส่วนตัวที่สะดวกสบายกันใช่มั้ยหล่ะครับ ซึ่งนอกจากเรื่องของการขับขี่ที่ต้องเป็นงานและเข้าใจตัดสินใจอย่างเฉียบขาดในทุกการขับแล้วนั้น เรื่องของการ “ดูแลรถยนต์” ก็เป็นสิ่งที่จำเป็นมากๆ เช่นกันครับ วันนี้เราเลยอยากจะพาทุกๆ ท่านไปพบกับ “4 วิธีการดูแลแบตเตอรี่รถยนต์” พร้อมกับสิ่งที่เช็คเกี่ยวกับตัวรถยนต์ด้วยครับ

ต้นกำเนิดแบตเตอร์รี่ที่น่าสนใจ

ด้วยความที่ว่า “รถยนต์ไฟฟ้า” กำลังมาแรงและถูกพัฒนาจนถึงขั้นที่เราคนทั่วไปสามารถหามาขับขี่ได้แล้ว จึงทำให้อุตสาหกรรมนี้เกิดการพัฒนาไปในรูปแบบต่างๆ มากมายที่น่าสนใจ โดยเฉพาะเรื่องของ “แบตเตอรี่” ก็เป็นสิ่งที่น่าศึกษาและกำลังถูกพัฒนาเพื่อตอบสนองความต้องการความจุกระแสไฟฟ้าที่มากขึ้นพร้อมกับลดเวลาในการชาร์จควบคู่กันไป วันนี้เราเลยอยากจะมาแชร์พร้อมกับรวบรวมข้อมูลเกี่ยวกับ “ต้นกำเนิดแบตเตอร์รี่ที่น่าสนใจ” ให้กับทุกๆ ท่านได้อ่านแบบคร่าวๆ กันครับ จะเป็นอย่างไรบ้างนั้น…เราไปชมกันดีกว่าครับ

5 วิธีใช้งานแบตเตอร์รี่ให้อายุการใช้งานมากขึ้น

การที่จะให้สิ่งของใดอยู่คู่กับเราไปนานๆ นั้น เราก็ต้องมั่นดูแลเอาใจใส่ก่อนจึงจะเป็นผลดีต่อสิ่งของเหล่านั้น เพราะการดูแลของได้ดีจะทำให้เราไม่ต้องเสียทรัพยากรหรือเงินในการซื้อสิ่งเหล่านั้นใหม่นั้นเองครับ เช่นเดียวกับ “แบตเตอร์รี่” หากเราดูแลได้ดีก็จะทำให้เราไม่ต้องเปลี่ยนแบตบ่อยๆ นั้นเอง จะต้องทำอย่างไรบ้างนั้น…เราไปชมกันเล้ยย!! 5 วิธีใช้งานแบตเตอร์รี่ให้อายุการใช้งานนาน ●หลีกเลี่ยงการใช้รถสำหรับการเดินทางระยะสั้นบ่อยๆ แบตเตอรี่ ทำหน้าที่จ่ายไฟเพื่อใช้ในการสตาร์ทรถ และจะชาร์จไฟกลับเข้าแบตระหว่างที่เราขับรถ ถ้าเราใช้รถสำหรับระยะทางที่สั้นมากๆ จะทำให้ไม่มีช่วงเวลาที่แบตเตอรี่จะได้ชาร์จไฟกลับเข้ามาเลย ทำให้กำลังไฟหายไปในช่วงนั้น และถ้าเราทำให้เกิดเหตุการณ์แบบนี้ซ้ำบ่อยๆ หรือทุกวัน จะส่งผลให้แรงดันไฟฟ้าลดลงไปจนสุดท้ายแบตเตอรี่สูญเสียกำลังไฟจนไม่สามารถชาร์จไฟเพื่อสตาร์ทรถได้ ●รักษาความสะอาดแบตเตอรี่ แบตเตอรี่ควรอยู่ในสภาพที่ สะอาด แห้ง…

เราจะดูแลแบตเตอร์รี่รถยนต์อย่างไรดี

เมื่อเราขับรถยนต์เป็นเวลานานๆ สิ่งที่ต้องดูแลหลักๆ แล้วนั้นก็คือ เครื่องยนต์ ล้อรถและตัวโครงรถต่างๆ และอีกหนึ่งสิ่งที่สำคัญเลยก็คือ “แบตเตอร์รี่รถยนต์ ” นั้นเองครับ สามารถเปรียบได้ว่า “แบตเตอร์รี่เป็นพลังงานรอง” ที่สำคัญไม่น้อยไปกว่าเชื้อเพลิงเลยก็ว่าได้ เพราะด้วยเทคโนโลยีในปัจจุบัน ส่วนประกอบต่างๆ ล้วนใช้ไฟฟ้าในการควบคุมกันทั้งสิ้น บทความนี้จะพาทุกๆ ท่านไปพบกับแนวทางที่ “เราจะดูแลแบตเตอร์รี่รถยนต์อย่างไรดี” กันครับ เพื่อเป็นการไม่เสียเวลา เราไปชมกันเล้ยย!! 4 ประเภทแบตเตอร์รี่ที่เราควรรู้จัก ●แบตเตอรี่น้ำ คือ…

Education

Job

ว่างงานนาน จะหางานบริษัทยากหรือไม่

ในการ หางาน บริษัทนั้น สิ่งสำคัญก็คือประสบการณ์ทำงาน เพราะองค์กรจะตัดสินว่าคุณมีคุณสมบัติเหมาะสม และสามารถทำงานให้สำเร็จได้หรือไม่นั้น จากประสบการณ์ทำงานที่คุณเคยผ่านมา เพราะเหตุนี้จึงทำให้ใครหลายคนที่ว่างงานนาน ๆ มักจะไม่มั่นใจในตัวเอง และกลัวการสมัครงานบริษัท การว่างงานนานไม่ได้เป็นจุดอ่อนในการ หางานบริษัทอย่างที่คิด ใครหลายคนที่ผ่านประสบการณ์ว่างงานนาน ๆ มาก่อน มักจะเข้าใจดีว่า ช่วงนั้นสภาพจิตใจจะย่ำแย่เป็นอย่างมาก คิดมาก และกังวลตลอดเวลาว่า เมื่อไหร่เราจะสมัครงานบริษัทได้เสียที ยิ่งนานวันก็จะยิ่งหมดความเชื่อมั่นในตัวเอง จนบางคนล่มเลิกความคิดที่จะหางานบริษัทไปเลยก็มี แต่เชื่อหรือไม่ว่า บริษัทที่มีผู้นำและผู้สัมภาษณ์ดี…

Lifestyle

Pet Food

เลี้ยงปลาคาร์พให้สีสวย ด้วยอาหารปลาคาร์พ Saiteki extreme color

ปัญหาของการเลี้ยงปลาคาร์พคือเลี้ยงอย่างไรให้ปลาคาร์พมีขนาดรูปร่างและมีสีสันที่สวยงาม บอกเลยว่าการเลี้ยงปลาคาร์พให้สวยงามนั้นไม่ยากเลย โดยควรให้ความสำคัญในเรื่องอาหารปลาเป็นหลัก ซึ่งปลาคาร์พเองถือเป็นปลาที่ได้รับความนิยมมาอย่างยาวนาน นอกจากคนส่วนใหญ่นำมาเลี้ยงเพื่อความสวยงามแล้ว ซึ่งการเลี้ยงปลาคาร์พนั้นควรเอาใจใส่ในเรื่องของอาหาร ควรมีสารอาหารที่เหมาะสมตรงกับความต้องการของปลา โดยเฉพาะสารอาหารที่ช่วยให้สีของปลามีความสวยสดชัดเจนยิ่งขึ้น อย่าง อาหารปลาคาร์พ Saiteki extreme color ที่เป็นสูตรเร่งสีปลาให้สวยงาม ซึ่งถือเป็นสูตรจำเป็นที่ต้องมีและขาดไม่ได้เลยสำหรับปลาคาร์พ ปัจจุบันยังนำมาเลี้ยงเพื่อความเป็นสิริมงคลด้วย นั่นเพราะมีลักษณะโดดเด่นของลวดลายและสีสันที่สวยงาม ซึ่งมีสีหลากหลายตามสายพันธุ์ เช่น สีแดง สีขาว สีเหลืองทอง สีน้ำเงิน และสีดำ หากใครชอบเลี้ยงปลาแล้วละก็…